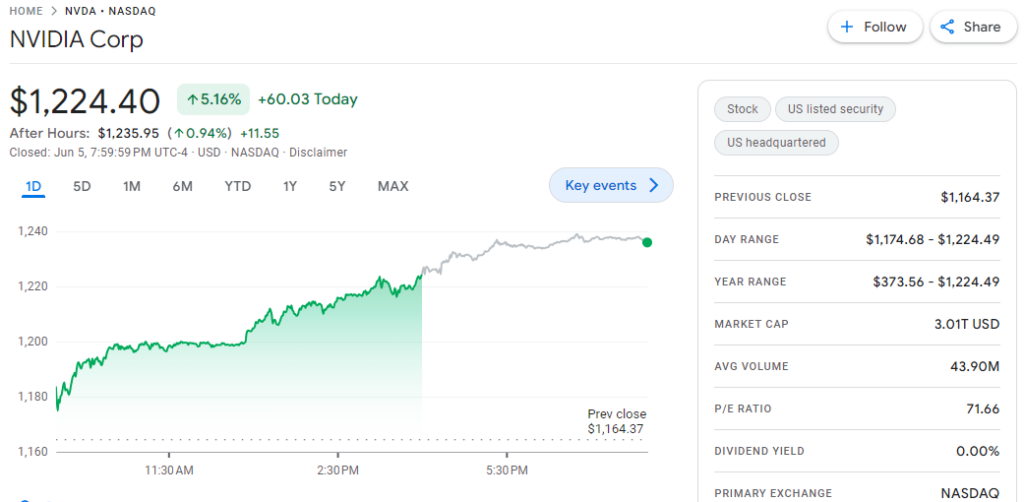

Tech Giant Nvidia surpassed Apple Inc. in intraday trading on Wednesday, to become the world’s second most valuable public company, with a market capitalization of $3.01 trillion driven by its dominance in Artificial Intelligence (AI) sector.

Nvidia’s increase in market value can be attributed to its dominance in the market for AI chips, which it controls an estimated 80%. The tech giant company that has been majorly invested in the production of Graphics Processing Units (GPUs) and system on chips units for data centers, has of late emerged to become a major supplier of AI-related hardware and software.

For instance, Nvidia’s data center business which has been on the rise in the Q1 2024 alone recorded $22 Billion which was 427% higher than the previous year’s statistics. Back in 2007, its revenue was $6 billion which constituted 86% of its total sales. The statistics clearly show the dominance of AI related products and services in the market.

Nvidia’s shift to become an AI technology provider has attracted significant attention from investors, which saw its shares rise by over 24% in early May after reporting Q1 FY 2022 earnings. The company’s stock has risen by more than 3,290% in five years.

While Nvidia has been rising steadily and by a large margin, Apple has been rather stagnant with a growth of only 5% this year. Apple was the first American company to achieve a $3 trillion market capitalization in January; however, of late, it has been exposed to threats, including slowing sales growth.

iPhone sales have also reduced by 10% than those of the same quarter of the previous year. Apple has also faced strategic challenges in some major markets such as China and varying receptions of new products like the Vision Pro virtual reality headset.

Whereas, Nvidia has managed to diversify into artificial intelligence and cloud computing, which has helped it to increase its market value. This is in line with today’s market dynamics where investors are targeting the firms that are in the leading position in AI technology.

Nvidia appears good for further gains, particularly with a 10:1 stock split planned in the current month which could make Nvidia shares easier to acquire.

Nvidia’s leadership in the AI chip market and its focus on developing GPUs for data centers have positioned them as a highly profitable and valuable company, showcasing the significant demand for AI capabilities across industries.

Also Read: Elon Musk Denies Diverting Nvidia AI Chips from Tesla to X