A prominent figure in mutual funds, Fidelity’s FBTC, drives renewed interest in Spot Bitcoin ETFs in the United States, attracting close to $600 million in total ETF inflows over the past two days.

Fidelity’s FBTC, traditionally overshadowed by BlackRock, saw a significant uptick with $220 million in inflows on June 5 alone. This brought its two-day total to nearly $600 million, pushing its assets under management past $9.5 billion. Despite this surge, BlackRock’s IBIT maintains double FBTC’s size in assets.

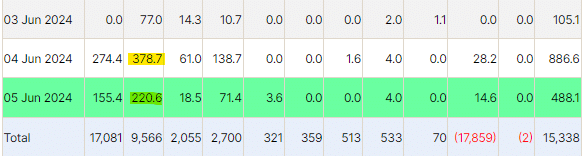

According to Farside Investors data, Bitcoin ETFs have experienced 17 straight days of positive inflows, with a net influx of $488 million on June 5 alone. Grayscale’s GBTC, FBTC, and IBIT attracted $14.6 million, $220.6 million, and $155.4 million, respectively, leading to cumulative net inflows surpassing $15.338 billion, a notable achievement given daily Bitcoin mining rates.

Franklin Templeton’s CEO noted this surge as the “first wave of early adopters,” anticipating a larger institutional wave to follow. CEO Jenny Johnson emphasized that current bullish sentiment underestimates future institutional involvement in Bitcoin ETFs.

Additionally, Franklin’s Bitcoin ETF boasts over $420 million in assets, smaller but significant in this landscape. This growth signals a broader acceptance of Bitcoin ETFs, aligning with the industry’s upward trajectory.

Fidelity’s FBTC demonstrates growing strength in the Spot Bitcoin ETF market, showcasing resilience against larger competitors like BlackRock’s IBIT despite the latter’s double asset size.

Also Read: Fidelity’s Spot Ethereum ETF Added to DTCC List; Awaits Regulatory Approval