Every major cryptocurrency is going to be affected by the upcoming Bitcoin halving, and the Bitcoin hardforks – Bitcoin Cash (BCH) and Bitcoin SV (BSV) – are no exception.

Both BCH and BSV-that are derivative forks of Bitcoin- have their own individual halving events. However, they are still affected by the Bitcoin Halving event which is barely four days away now.

After a somewhat cold-response to BCH halving that occurred on 3 April 2024, market players have now started speculating whether the BCH price will cross the $1000 price mark post Bitcoin Halving.

A Bitcoin hard fork is a change in the network protocol of blockchain, thereby splitting the chain into two separate branches. Despite the forks having inherited the technical architecture of Bitcoin, they have their own individual halving events same as Bitcoin and it majorly influences their economy.

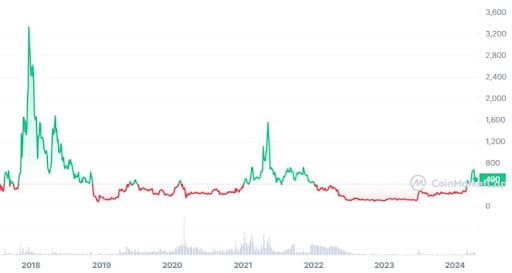

Bitcoin Cash had its own first halving in 2020 which successfully enhanced the BCH price and its economy. During the first halving, BCH was trading nearly $250 which rose to $1,550 – recording a gain of over 520% over the period of 14 months till the cycle top. However, it was still far away from the all-time high of $3,324, marked during their launch in 2017 – according to data from Coinmarketcap.

Now as the second Bitcoin Cash halving just occurred, it is expected that BCH price will march towards new highs in the crypto rally fueled by the Bitcoin halving. We know that halving is a major economic event for the Bitcoin ecosystem and its main aim is to combat against the BTC inflation and control demand and supply. This leaves a significant impact on Bitcoin, Bitcoin forks and other cryptocurrencies.

How Halving on Bitcoin Cash is Different

Bitcoin Cash possesses a faster blockchain network than Bitcoin in processing transactions and block mining. This is the main reason why halving on Bitcoin Cash occurred earlier than that of Bitcoin. Bitcoin Cash has only been through two halvings whereas Bitcoin will count its fourth halving on April 19. The latest halving on Bitcoin Cash chopped mining rewards from 6.25 to 3.125 BCH per block.

Despite being a somewhat faster and lighter fork, Bitcoin Cash is facing lack of adoption and not having any key-performance indicators (KPIs) that could boost its market position further. The next few months will decide if Bitcoin Cash will survive or not as it has failed to show any remarkable stand since the hard-fork launch in 2017.

Also read: Bitcoin Cash Open Interest Decreases 47% Post-Halving

FAQs

Is Bitcoin Cash halving different than Bitcoin?

Yes, halving on both Bitcoin Cash (BCH) and Bitcoin (BTC) blockchain are different.

When was the Bitcoin Cash halving?

The first halving on Bitcoin Cash occurred on 8 April 2020 and second halving occurred on 3 April 2024. Bitcoin Cash only had two halving since its launch in 2017. The next Bitcoin halving will occur in 2028.

Does Bitcoin halving impact BCH supply?

Bitcoin halving does not impact on BCH supply as Bitcoin and Bitcoin Cash both are different blockchain.