The most anticipated event in the cryptocurrency ecosystem- the fourth Bitcoin halving of 2024– is now less than 10 days away and it has already created a real buzz in the global crypto community.

The world is now waking up to this upcoming significant event that is set to disrupt the cryptocurrency market and hopes are set that the BTC will reach a new benchmark value of $150,000.

The 2024 halving is giving a different kind of bullish vibes than the previous halvings and Bitcoin is expected to kick off a never-seen-before price rally.

A common Bitcoin price prediction among most of analysts is the psychological mark of $150,000. However, the recent involvement of spot Bitcoin ETFs and the increased selling pressure raises the question if Bitcoin will be able to break even $100,000 in the meantime!

In this report, we evaluate the factors that could shoot up Bitcoin price to the much-fabled $150,000 mark post the halving and what are the evidence to support the predictions.

Bitcoin Cyclic Gains Hinting $150,000

If we look back to the previous halvings, this event had always carried a ‘Bullish sentiment’ when it comes to the Bitcoin price as well as to the entire cryptocurrency market. The cyclic gains through all previous halving have proved that Bitcoin’s value has increased several times over, rather dramatically. This could only mean that the upcoming event could take BTC to newer heights.

The table mentioned here describes the Bitcoin price movement during all the previous Bitcoin halvings until the peak of that cycle.

| Halving | Price Movement | Gains Until Cycle Top |

| 1st (2012) | $12 to $1,161 | 9300% |

| 2nd (2016) | $600 to $20,000 | 2800% |

| 3rd (2020) | $9,000 to $69,000 | 620% |

Bitcoin surged 9300%, from $12 to $1,161 post the 1st halving which took roughly 13 months. By repeating this method it spiked over 2,800%, from $600 to $20,000 after the 17 months of second halving in 2016. In the past halving, Bitcoin price recorded a gain of 620% from $9,000 to $69,000, within just 11 months of 2020 halving taking place.

These numeric gains are used in a regression model to calculate expected gains in the upcoming timeframe. This calculation leads to believe that Bitcoin price could see at least 140% gain post the fourth halving, putting Bitcoin’s estimated price at $168,000 if considered the current market price of $70,000.

Analysts Predict Bitcoin Price To Reach $150,000

Based on these periodic gains, several analysts have come up with the common prediction of $150,000 per BTC post the fourth halving. This includes a prominent wealth management firm Bernstein and several other investors.

While fueling this prediction, a recent report from Bitfinex also revealed that Bitcoin is likely to touch the price mark of $150,000 due to several economic factors. This major prediction highlighted in the report is calculated using the regression model, which predicts that Bitcoin price could surge 140% in the post-halving phase. The analysts from Bitfinex also said that this massive price movement will happen in the next 14 months.

The Spot Bitcoin ETF Inflows

Within three months of its launch, spot Bitcoin ETFs have managed to acquire approximately $57.8 billion of Bitcoin, according to ETF data from Sosovalue. The approval of Bitcoin ETFs embarked much positivity among the Bitcoin community but the cold interest of traditional finance players at the initial level turned excitement into sighs.

Although it’s also said that the ETF inflow will gradually increase and it would dominate the non-ETF Bitcoin supply holding over time. If that happens, ETFs could hold Bitcoin worth over a trillion dollars which directly doubles its current market cap. If the inflows from ETFs rises from a point of accelerating the price rally, it could significantly impact in pushing Bitcoin to the predicted high of $150,000 or beyond.

Despite these bullish signs, there also seem to be several macro-economic factors that could significantly impact the Bitcoin economy. This includes the Federal Reserve’s interest rate announcement and the recently improved job market in the US. Moreover, it’s for the first time that Bitcoin broke its previous all-time high before halving, which usually happened in the next couple of months of halving.

Odds Against $150,000

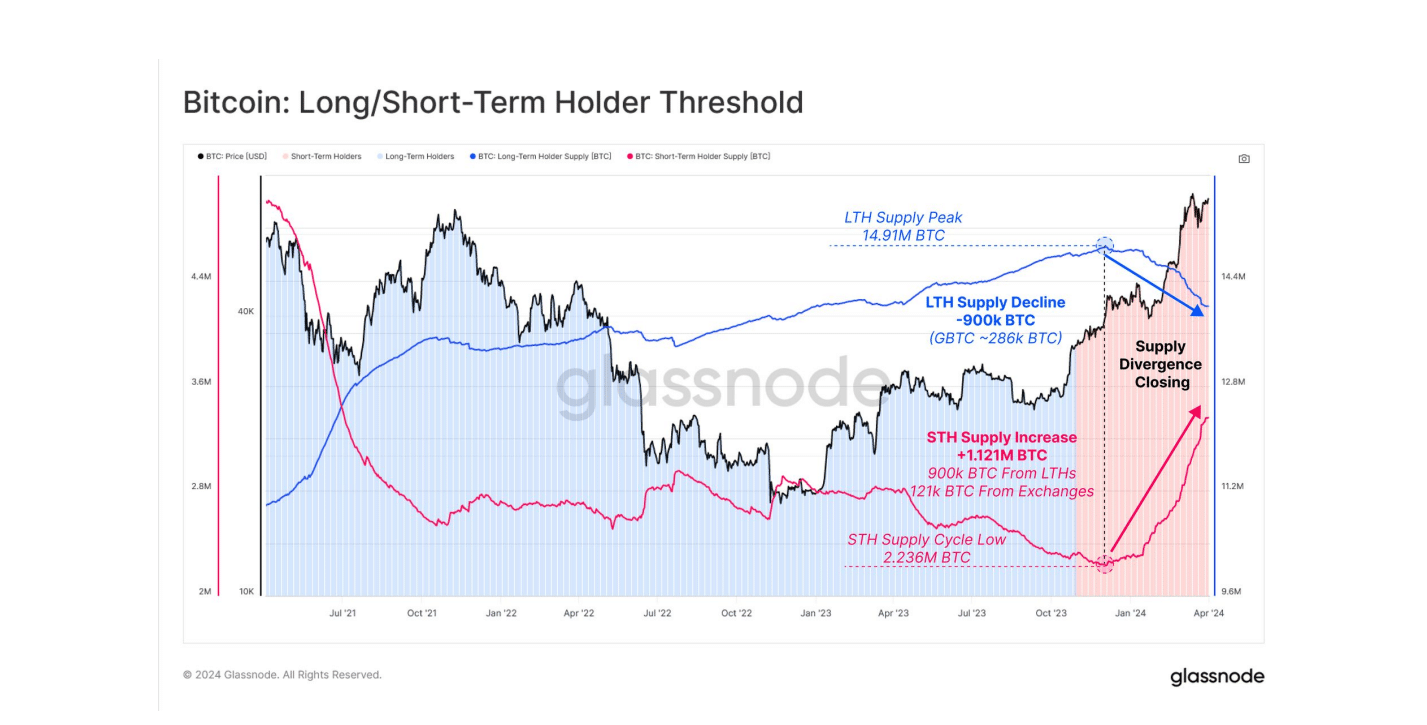

One of the determining factors to look for is the recently increased dominance of short-term holders of the current Bitcoin circulating supply. There are now more short-term Bitcoin holders than long-term holders who took exit at the cycle low near December. This closely matches with the increased number of short-term holders who have taken their positions during the timeframe of December to January, according to data provided by Glassnode.

Such a scenario gives unpredictable market movement while increasing selling pressure in the current market. It also coincides with the increased activity of moving Bitcoins as more wallet changes are taking place than ever before.

Final Words

With the fourth Bitcoin halving is expected to occur on 20th April, Bitcoin has already started showing high volatility amid bullish speculations around its potential price surges. While $150,000 remains a key predicted price by major analysts, it is likely to reach near the mark by the end or early 2025. It is just now a matter of time when Bitcoin catches up with the acceleration and gets into its price discovery phase for the fourth bull run of 2024.