Digital asset investment products have witnessed an unusual inflow of $708 million in the past week.

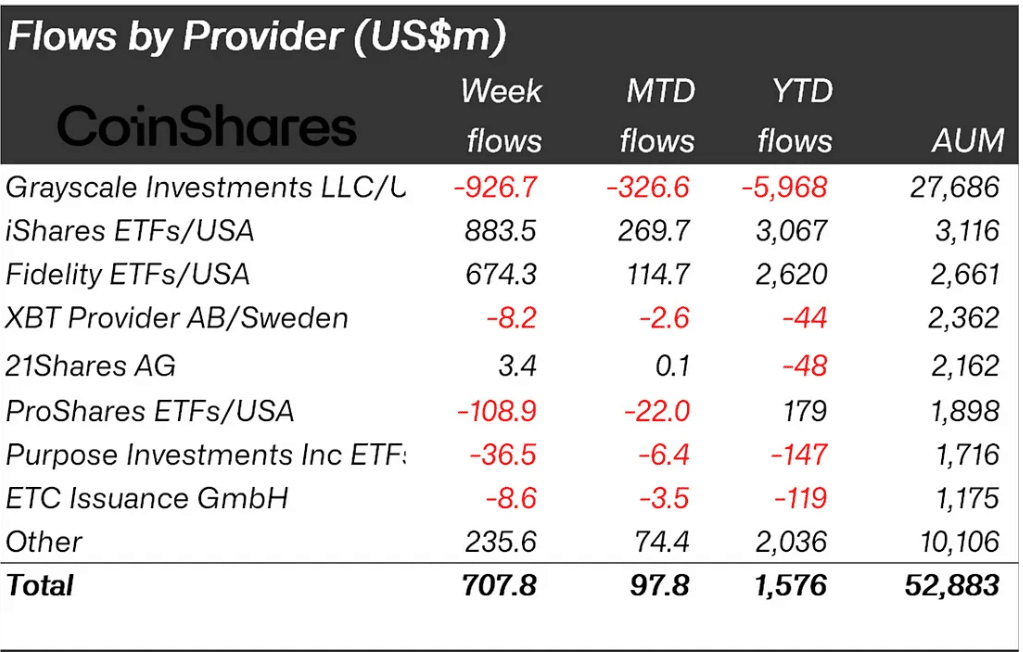

According to CoinShares’ report, the last week saw a remarkable inflow of $708 million into digital asset investment products. This has pushed the total for 2024 to $1.6 billion, bringing the global assets under management (AUM) to $53 billion.

There has been a decline in the trading volume of exchange-traded products (ETPs) from $10.6 billion the previous week to $8.2 billion.

Bitcoin influenced the previous digital asset investment landscape, which secured $703 million in inflows, representing 99% of the total.

In contrast, funds positioned against Bitcoin experienced a slight outflow of $5.3 million. Meanwhile, Solana made a notable impact by attracting $13 million, surpassing Ethereum and Avalanche, which faced outflows of $6.4 million and $1.3 million, respectively.

The U.S. market has driven funds into digital assets, recording $721 million in inflows. The introduction of fresh ETFs has contributed to this trend, with $1.7 billion gathered since their launch. Spot Bitcoin ETFs, in particular, have attracted an average of $1.9 billion in capital monthly, a total of $7.7 billion since their approval.

Also Read: French Citizens Shifting Investment Focus on Digital Assets