A sharp decline in Bitcoin price has nearly wiped out crypto market’s over a week of gains within an hour.

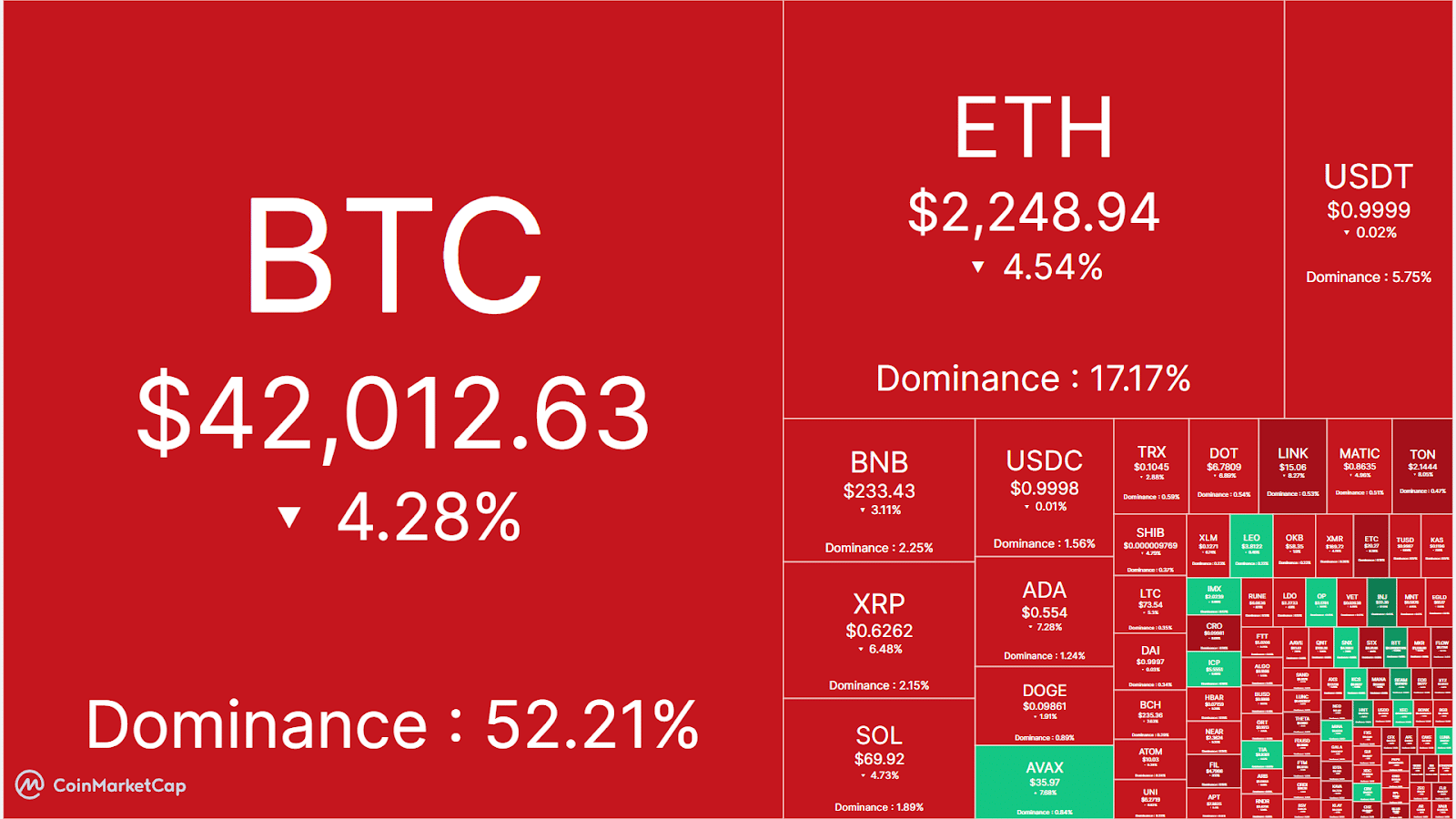

The price of Bitcoin fell nearly 4.5% from $43,345 to $41,649 in just an hour on December 11 at around 2AM UTC, according to crypto market data from Coinmarketcap.

As usual, the whole cryptocurrency market has followed Bitcoin’s lead and witnessed a sharp drop in market price. Ethereum (ETH) has seen a decline of over 6% in minutes, while other altcoins, including Binance Coin (BNB), Ripple (XRP), Solana (SOL) and others, have also dropped nearly 5% during the period.

Crypto Heat map shows drops in almost all the top 100 tokens listed on the Coinmarket Cap.

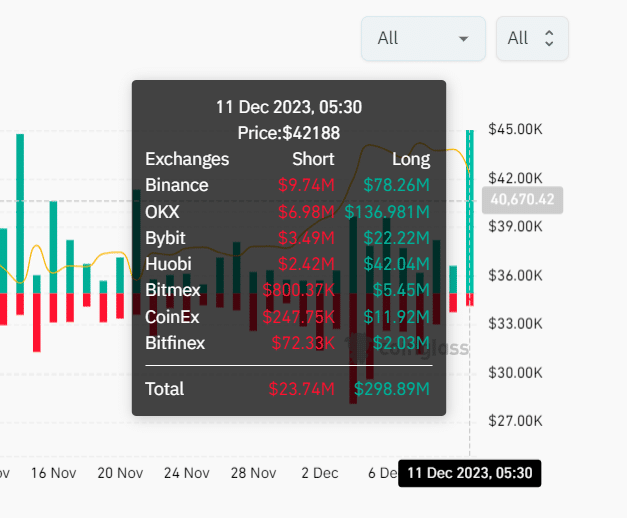

While the reason seems unidentified for this unexpected dump on December 11, it has been recorded as one of the biggest long liquidation day which wiped out a total of $298 million of long positions, according to Coinglass data.

The market downturn has occurred after a two week long continued rally which led the Bitcoin price from $37,000 to breaking its 19 months high of $44,000 during the last week.

This recent surge is highly influenced by the optimism around the approval of spot Bitcoin ETFs and expectations over the FED’s upcoming move of cuts in interest rates as well as the Bitcoin halving, altogether creating a bullish stance on the Bitcoin price for 2024.

Also Read: Cardano Leads Altcoin Surge Amidst Bitcoin’s Steady Performance