In its latest research report, Grayscale Investment said that Bitcoin supply dynamics could have a huge impact on BTC prices in 2024.

While Bitcoin is nearing its fourth halving, which is expected to occur in April 2024, its already tight supply could see a high demand during next year as several spot Bitcoin ETFs are also seeing an optimistic stance for approval.

“Bitcoin’s supply is relatively “tight” ahead of potential investor inflows into spot ETF products in the US,” said the report. Grayscale is one of the dozen entities awaiting SEC approval for its spot BTC ETF.

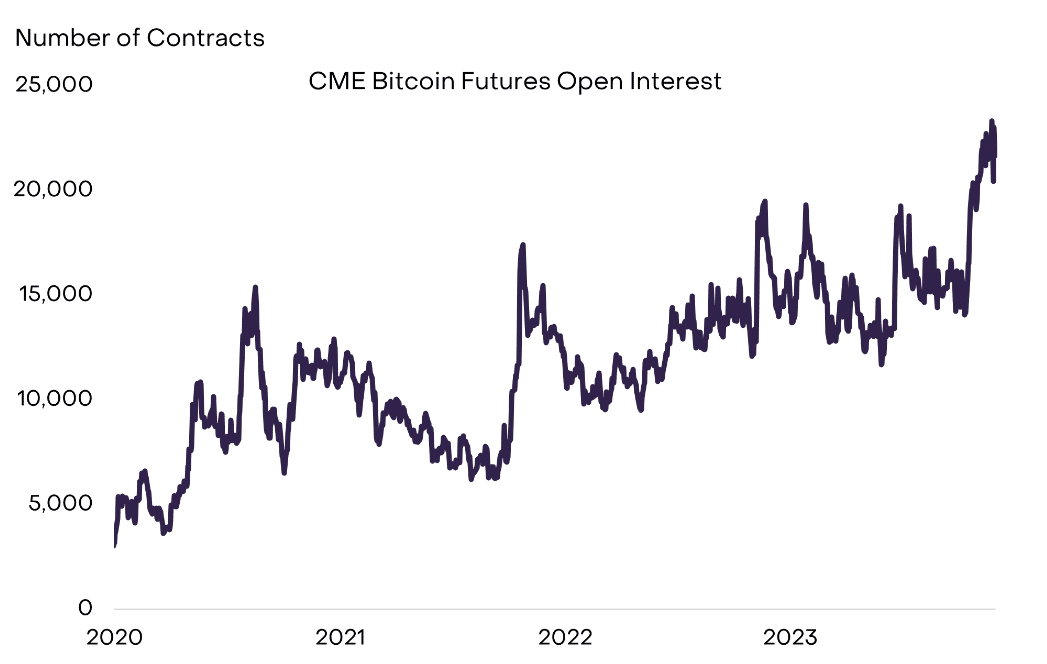

The report further stated that as Bitcoin continues to rise, the selling is likely to be reduced. It has also noted apparent evidence affecting Bitcoin’s growth such as increased Bitcoin network’s mining hash-rate as well as record high open interest for Bitcoin futures on CME.

“The combination of ‘tight’ token supply, easing macro risks, and the focus that the US presidential election will bring to excessive government borrowing may be positive for Bitcoin valuations in 2024,” said Grayscale.

Also Read: Investors Withdraw $1B of BTC Out From Crypto Exchanges