It is difficult for new investors to make money in the current crypto market as Bitcoin has not budged above the $30,000 level despite several attempts. From the looks of it the bears have turned up the selling pressure at $30,000 level causing the BTC price to often lose its bullish momentum at this price point.

Bitcoin price appears less volatile this week within two bearish patterns amid negative market sentiment. However, buyers have barely attempted to propel BTC above $30K. despite attempts, BTC is warning of an aggressive sell-off ahead as price action forms a double-top formation.

Bitcoin continues to trade under selling pressure like the past week

Buyers face a significant challenge in pushing the price of BTC through the supply zone and above $30,000. After a bearish reversal, the bears began to dominate BTC on the first day of the week, which led to a red weekly candle.

Last week, BTC price declined by 2.64% as the bears aggressively refused to leave the $29,580 supply zone. The 200-week simple moving average is approaching the $26,600 to $27,200 demand zone, which could reverse the trend for the next bullish cycle.

Bitcoin Forms Bearish Pattern

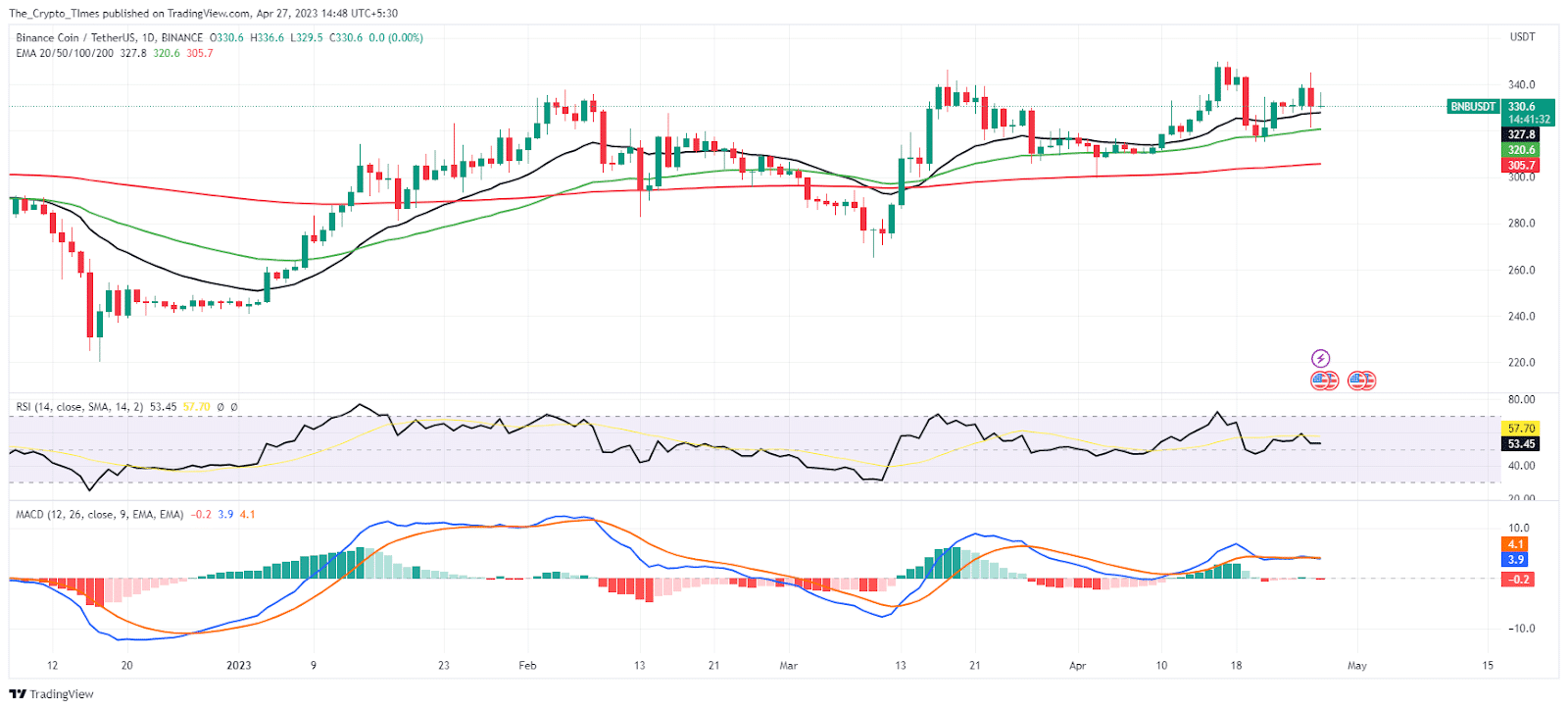

On the daily price chart, BTC failed to clear the $30K resistance area and formed a double top formation with the $27,900 neckline. BTC has already formed three daily bearish price candles, and another bearish candle could spell big trouble for investors.

Right now, Bitcoin price is trading around $28,250, with a 2.34% overnight drop. Trading volume is present at $13.18 billion, showing a 12% loss in the last 24 hours according to CoinMarketCap.

The daily RSI declined to the 50 level and reached the 46 mark. The RSI is showing a bearish signal, and the bears could aggressively dump the largest cryptocurrency towards $27,000 – a vital support level.

The bearish crossover could set up a fall of 1000 points

Recently, traders noticed a 20 DMA cross below the 50 DMA. Furthermore, the MACD indicator is providing support to the sellers of the market as it is moving down to reach the negative zones. Both these bearish signs create panic among the investors, which can lead to a further fall of 1000 points.

Also read: Bitcoin Recovery Traps Buyers After Failing to Surpass $30K Zone

DISCLAIMER:

This piece is for educational purposes only and not financial advice. Investors should do their own research before buying and selling cryptocurrency, NFTS, or other digital assets.