Last month, Uniwap outperformed Coinbase in terms of market share as traders shifted to decentralized exchanges (DEX) in response to American regulatory restrictions and a financial crisis that led to the de-pegging of important stablecoins from the dollar.

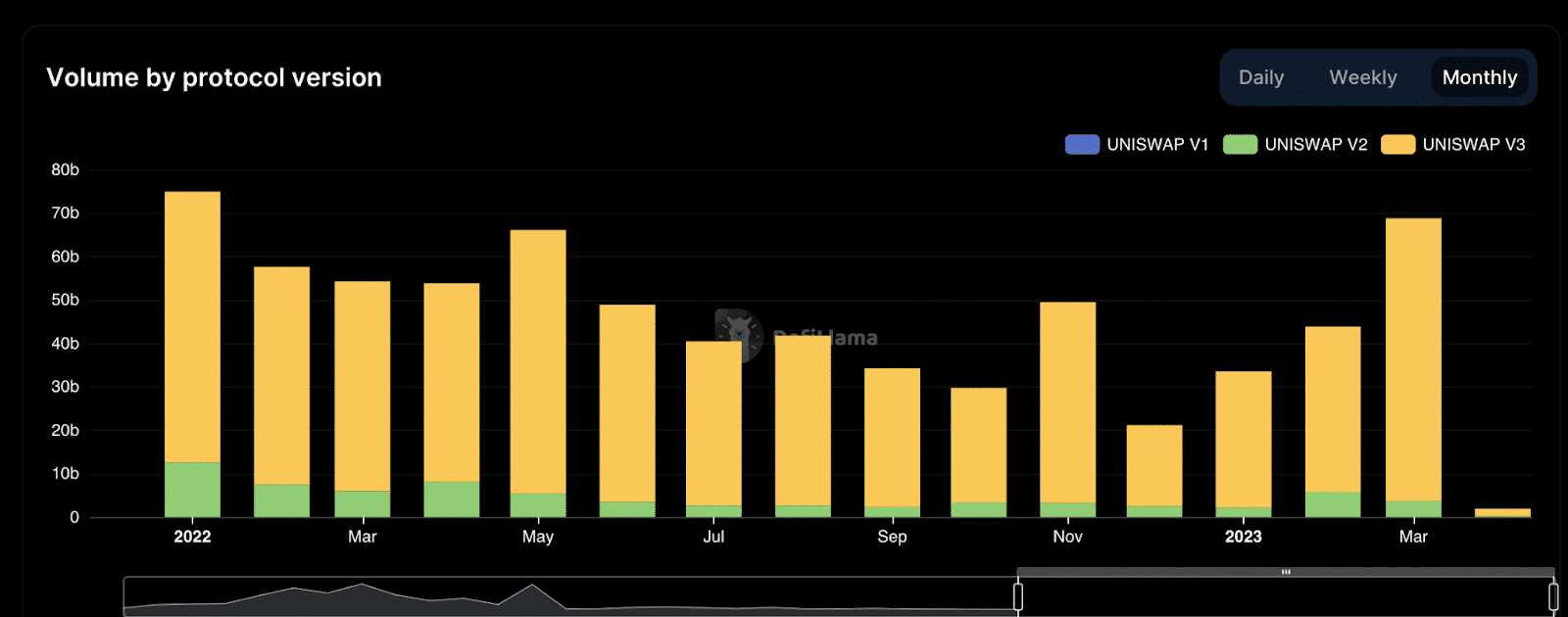

According to data from DefiLlama, Uniswap handled more trade in March than centralized exchange (CEX) Coinbase ($49.2 billion vs. $70 billion). The increase was timed to coincide with a 10-month high in overall DEX volume.

The U.S. Securities and Exchange Commission (SEC) informed Coinbase of a planned enforcement action in March.

Furthermore, the fall of Silicon Valley Bank (SVB) caused the price of two essential components of decentralized finance (DeFi)—the USD coin (USDC) from Circle Internet Financial and the DAI from MakerDAO—to fall below their normal $1 value.

This sparked a flurry of DEX trading as nervous investors moved their money. On March 11, Uniswap saw $13.3 billion in activity during that crisis, whereas Coinbase only saw $1.7 billion.

Also Read: Revolutionizing Crypto Trading: Top 7 Decentralized Exchanges for 2023