The Co-Founder and CEO of Cred Protocol explained the results of developing one of the first credit scores for the DeFi space based on blockchain data from accounts borrowing via the Aave v2 liquidity protocol.

Cred Protocol’s mission is to bring DeFi lending to 1 billion people by providing access to basic financial resources, for which risk quantification at scale is critical.

It enables web3 smart contracts to make better risk-based decisions in order to access over-collateralized lending services and DeFi loans.

They put the mantra “liquidation being a good proxy for the default” at the heart of the credit score that predicts Aave v2 users’ propensity to be eligible for loan liquidation in the near future.

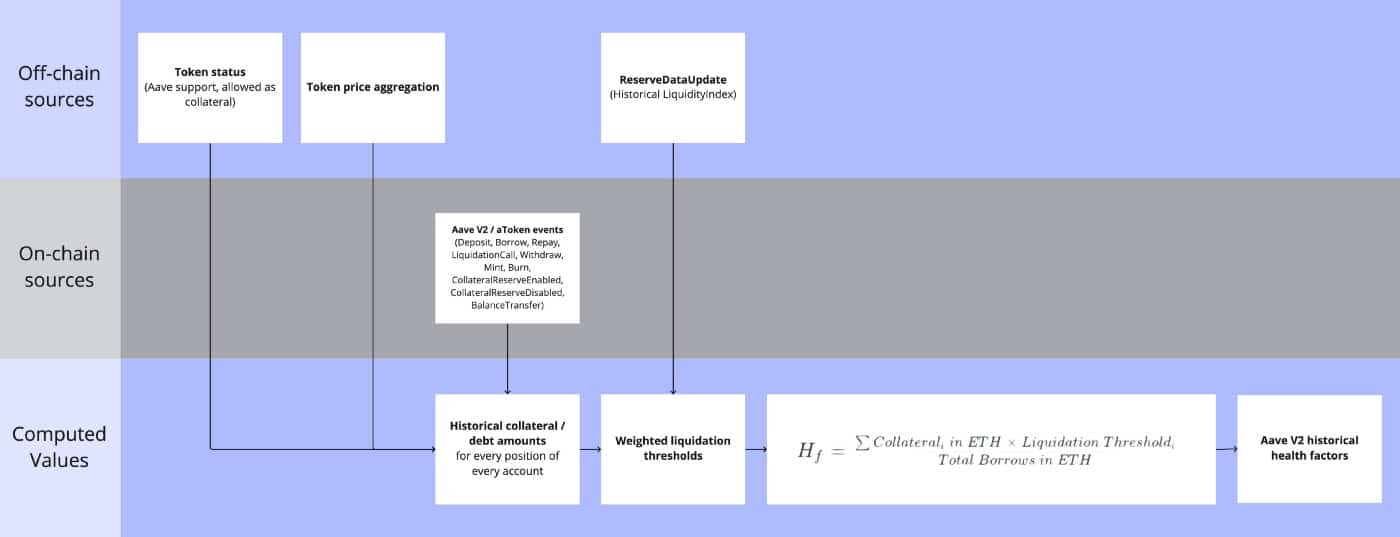

The dataset used to power this model comprises the health factors and collateral/debt composition of all Aave v2 accounts at 15-minute intervals from their initial Aave interaction until the present. It has over 360 million observations.

The health factor ensures the Aave protocol’s solvency by removing bad debt (under collateralized debt) from the system.

When a user’s health factor falls below 1, they are liquidated.

Also Read: Why you should take a Cryptocurrency Loan?

Cred Protocol has created a high-fidelity dataset for 35K Aave accounts since the inception of Aave v2. It provided a sophisticated classifier of the likelihood that an account’s position will be liquidated (HF<1) within 90 days of being opened.

This classifier included the following features:

- Account age

- Aggregations of the time series of its historical health factors

- Interactions with the Aave protocol

- The types of assets it borrows and keeps as collateral

Cred Protocol highlighted its plans to expand beyond the Aave protocol and analyze data from other lending protocols, such as Compound and MakerDAO.