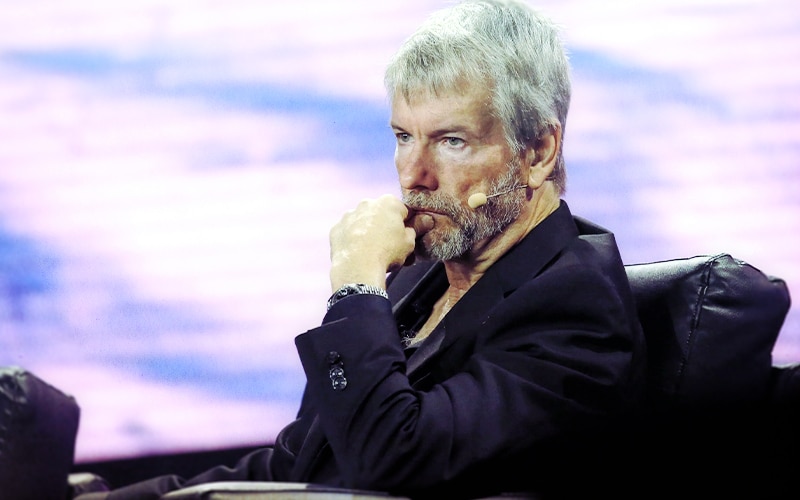

One of the largest corporate holders of bitcoins, as we know it, Michael Saylor’s MicroStrategy, is making headlines because of the current crypto market slump. MicroStrategy has suffered a roughly $1 billion loss on its Bitcoin holdings as the coin dropped below $24,000.

MicroStrategy and its subsidiaries held approximately 129,218 bitcoins at an average purchase price of around $30,700 per bitcoin, totaling nearly $4 billion, according to its most recent purchase of 4167 Bitcoins for nearly $190.5 million.

With Bitcoin falling to $21,947, MicroStrategy’s holdings are now worth slightly more than $3 billion. This amounts to nearly $1 billion in unrealized losses for the company.

Saylor dismissed talk of a margin call last month, claiming that a problem would arise only if bitcoin reached $3,562.

The funds used to purchase the bitcoin were most likely sourced from the proceeds of MicroStrategy’s recent $205 million loan from Silvergate Bank, which is one issue weighing on the company, as is the possibility that a further drop in Bitcoin prices will cause the posting of additional collateral.

Also read: Bitcoin Crash Leads to Over $800M in Liquidations

On Monday’s Nasdaq close, MSTR, a bitcoin-accumulating business intelligence software company, fell to 152.15 per share.